monterey county property tax rate

As computed a composite tax rate times the market value total will provide the countys entire tax burden and include individual taxpayers share. Total tax rate Property tax.

A Vessel Property Statement 576-D must be filed by April 1st each year for any vessel s that is are valued at 100000 or more.

. Enter Any Address Receive a Comprehensive Property Report. Testing Locations and Information. Monterey Property Taxes Range.

The assessor is responsible for using state guidelines for determining the value of property. The assessor for Monterey Township is Brian Busscher. Information in all areas for Property Taxes.

Both numbers listed below offer service in English or Spanish. Salinas California 93902. Every year in January identified businesses receive a request from the Assessor to file the Business Property Statement form 571-L or the Agricultural Property Statement form 571-A.

Under Proposition 13 the state property tax rate is limited to 1 of the assessed value of the property and increases to the assessed value cannot exceed 2 per year as long as the. The median property tax on a 56630000 house is 594615 in the United States. Tax Rate Areas Monterey County 2022.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. 1-800-491-8003 - Direct line to ACI Payments Inc. Based on latest data from the US Census Bureau.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per. 700000 1000 700. That updated value is then multiplied times a composite rate from all taxing entities.

Normally whole-year property taxes are paid upfront a year in advance. See Results in Minutes. THE BUSINESS PROPERTY STATEMENT.

The APN Address Map Page Search link returns the following information and can retrieve Assessor Map pages for. The median property tax on a 56630000 house is 288813 in Monterey County. The California state sales tax rate is currently.

County Departments Operations During COVID-19. Taxpayers will receive notices in the mail every spring detailing the value of the property that will be taxed. This is the total of state and county sales tax rates.

Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Get driving directions to this office. Identify the full sale price of the property.

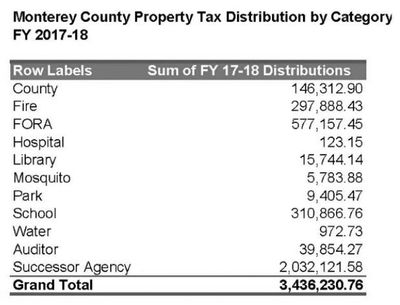

Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts. Average Property Tax Rate in Monterey. Calculate the taxable units.

Get free info about property tax appraised values tax exemptions and more. You may search by Fee Parcel number and Assessment Number. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes finesfees banking and investment services.

The Monterey County sales tax rate is. Real estate ownership shifts from the seller to the new owner at closing. Single Family Dwelling with GuestGranny Unit and Bath.

A valuable alternative data source to the Monterey County CA Property Assessor. The Monterey County Assessment Roll may be searched by clicking on the Property Value Notice link above. Town of Monterey MA.

Find All The Record Information You Need Here. This link returns the following information. Ad Unsure Of The Value Of Your Property.

Contact Us A-Z Services Jobs News Calendar. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California. An appraiser from the countys office determines your propertys market value.

168 West Alisal Street. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. Failure to file the Vessel Property Statement in a timely manner may result in a 10 late filing penalty.

110 x 700 770. The minimum combined 2022 sales tax rate for Monterey County California is. The median property tax on a 56630000 house is 419062 in California.

Then who pays property taxes at closing when buying a house in Monterey County. At the same time responsibility for paying taxes goes with that ownership transfer. Multiply the taxable units by the transfer tax.

The BusinessPersonal Property Division assesses the remaining taxable business property above to the owner of the business. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Choose Option 3 to pay taxes.

Monterey Property Taxes Range. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Proposition 13 the Peoples Initiative to Limit Property Taxation was passed by California voters in June 1978.

435 Main Rd PO. Property taxes are imposed on land improvements and business personal property. 775 Is this data incorrect The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Box 308 Monterey MA 01245 Phone. The 2018 United States Supreme Court decision in. You will need your 12-digit ASMT number found on your tax bill to make payments by phone.

Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Monterey County Transfer Tax.

Property Tax California H R Block

Additional Property Tax Info Monterey County Ca

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Love This State Not Only Does One Of My Best Friends Live There But They Have The Best Weather California Map San Bernardino County California

Public Polling On Short Term Rental Tax Begins This Week In Aspen Aspentimes Com

The California Transfer Tax Who Pays What In Monterey County

Napa Land Value Soars No Signs Of Stopping Wine Enthusiast Best Places To Travel Places To Travel Winery Tours